Blog

Are Robo-Advisors are taking over Wealth Management?

DHF Capital believes that human interaction and robo advisors both are significant for wealth management quality and success today.

Robo-Advisors are a type of financial advisors that provide automated investment management and financial advisory services online, using mathematical rules and algorithms, with little to no human intervention.

So while the financial segments worldwide have embraced the digital wave, one cannot keep human interaction at bay. Almost every trade or transaction from day-to-day processes to business strategies are being transformed digitally as the world becomes more streamlined, smart, smooth, efficient and convenient. The process of digitalisation is being applied to the finance and wealth management industry, as it looks to new technology such as robo-advisors to improve services and reach a wider audience. There has been a significant rise in robo-advice digital acceptance by both small fintech start-ups and larger financial institutions globally. However with efficiency and smart operations, comes the need for confidence and comfort that only humans can provide.

DHF Capital believes that in a digitized world one cannot absolutely negate the efficiencies robo-advisors bring to the table by using automated, algorithm-based systems to provide portfolio management advice. However asset and wealth managers tend to listen to the customers (or investors), advise on tailor made investment portfolios and execute the same. Ever since the digital transformation and the widespread adoption of digital devices, customer expectations have changed and continue to do so at a rapid pace. Today, convenience and efficiency are a top customer priority. The common objective for both robotics and wealth managers is customer-centric convenience and satisfaction creating an ideal scenario is where efficiency meets personalization. While it has been proven robo-advisors are trusted and affordable and offer financial advice for everyone, regardless of net worth, human managers like DHF Capital needs a minimum investment portfolio of X million USD

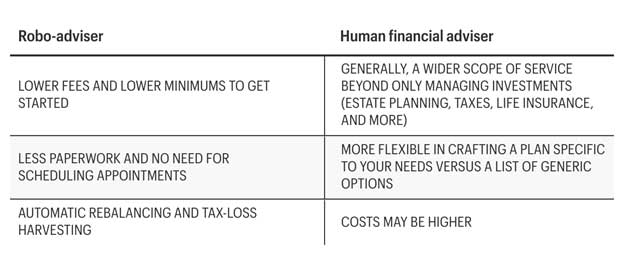

Robo-advisors are less expensive than traditional advisors and lack an irreplaceable human element, which prevents them from providing the essential qualities and services characteristic of traditional financial advisors. When you look more closely at the differences between the two, it seems obvious that robo-advisors could never truly replace human financial advisors. It would be safe to establish the fact that wealth managers like DHF Capital have been making as steady a progress as their robotic counterparts, sometimes even a tad bit more. Robo-advisor vs. human advisor

There are various ways to gauge whether a robo-advisor or a human advisor is best to help you manage your finances. If you’re looking for an automated, low-cost way to manage your finances, a robo-advisor might feel like a natural fit. For those who want the one-on-one attention and a more tailored approach, a human financial advisor may prove the better option. Below are additional comparisons between the two.

DATA BY FORTUNE/NICK RAPP

DATA BY FORTUNE/NICK RAPP

As of 2018, robo advisors managed an estimated $257 billion worth in assets which is expected to increase to half a trillion by 2023. Despite the impressive growth, people are divided into two lots: one who think of robo - advising as the next-game changing innovation in the investment world, while there are others who think of it as just a passing fad.

A recent study by LendEDU found that Millennials, once believed to be the biggest proponents of robo-advisors, actually chose human advisors nearly two-to-one over automated investment services. Other findings from the study revealed that 52% of Millennials believed that robo-advisors are more likely to make mistakes, and nearly 70% thought a human advisor would get a better return on their investments.

When you compare a robo-advisor to a human financial advisor, the key difference is a human advisor’s ability to offer emotional guidance. DHF Capital feels that meeting their clients face-to-face allows them to provide behavioral coaching and hand holding, helping clients develop positive budgeting and wealth management habits that lead to long-term financial security. When markets decline or tricky situations arise, they work with clients and assist them make rational financial decisions.

The asset managers at DHF Capital provide personalized counseling and guidance to help clients achieve long-term financial success. Automated online platforms are unable to match this level of personalization. While traditional financial advisors may use similar strategies, they also rely on professional history, as they have worked with a variety of clients with different kinds of financial situations. Additionally, it is imperative one works with a team or have additional financial tools to determine the best investment objectives for each client.

Investment advice is just a small part of a complete financial plan. Human financial advisors are able to create customised investment strategies and provide comprehensive financial planning that includes retirement, insurance, and estate planning services, the best exercise of stock options, cash flow monitoring, and more to help clients achieve their financial aspirations.

For financial institutions to remain relevant in wealth management, they must adapt to the digital transformation process and methods. Today, several wealth management firms are either partnering with or acquiring and even building their own technology solutions to meet the increasing demand for a better customer experience that robo-advisors offer.

Traditionally, wealth managers have been dependent on the private banker and personal relationships to predict client requirement and ensure flawless customer experiences. Although digitalisation will never replace that personal human touch, but will help quickening up the on-boarding process, using customer data to predict individual’s needs and by removing paper from processes.

While robo-advisors are gaining more capabilities and media attention, they aren’t close to replacing human financial advisors. Robo-advisors may be useful for beginner investors with limited assets, but they lack the full range of benefits that would let them serve as true replacements for traditional, human financial advisors. If your finances could benefit from a personal touch, please contact DHF Capital for a personalised consultation.

Related Posts